See our updated 2025 Detailed Depreciation Analysis for the Skoda Enyaq. Review for updated and details here.

For savvy consumers, the Skoda Enyaq marks a significant stride into the blossoming landscape of electric vehicles (EVs), but understanding its depreciation is key when optimizing vehicle investment. Initially, the Skoda Enyaq depreciation followed the familiar downward trajectory of new car values, yet recent market shifts hint at a more promising outlook. As we delve into the factors affecting Skoda Enyaq value, it is essential for buyers and enthusiasts alike to recognize the intertwined influence of market evolution and technological advancements.

As supply bottlenecks such as the notorious chip shortage begin to loosen, the once-rigid lead times for new EVs are easing, bringing forth a tide of change with more competitively priced in-stock options. These transitions signal a potential paradigm shift for the Skoda Enyaq’s hold on its value. With a prudent eye towards these dynamics, stakeholders can approach the EV market with confidence, equipped with strategies for optimizing vehicle investment.

Key Takeaways

- Heightened consumer interest in EVs is reshaping the Skoda Enyaq’s depreciation landscape.

- Increased electric vehicle supply and resolving chip shortages are pivotal factors affecting Skoda Enyaq value.

- Enhanced affordability of new models invites negotiation, fostering a competitive market conducive to value preservation.

- As EV lead times normalize, Skoda Enyaq owners may enjoy a slower depreciation rate, safeguarding their investments.

- Insight into depreciation trends and market conditions is paramount in optimizing vehicle investment for prospective EV owners.

- See our updated 2025 Detailed Depreciation Analysis for the Skoda Enyaq. Review for updated and details here.

The Impact of Market Dynamics on Skoda Enyaq Depreciation

As the electric vehicle market continues to grow, a complex web of market dynamics, from prolonged lead times to production bottlenecks like the automotive chip shortage, have been influencing the resale values of electric vehicles such as the Skoda Enyaq. With multiple factors at play, the Skoda Enyaq price drop in the secondary market is becoming a noteworthy trend, suggesting a shift that could redefine the EV ownership experience.

Evolution of EV Market and Lead Times

Not long ago, the burgeoning demand for electric vehicles and a limited supply chain led to extended wait times for new vehicles, at times exceeding a year. This scarcity inflated the secondary market, as consumers were willing to pay premiums for quicker access to EV models like the Skoda Enyaq.

Chip Shortage Effects on Vehicle Pricing

The automotive chip shortage posed significant challenges to the production of electric vehicles, which traditionally require a higher number of chips than their combustion counterparts. As the shortage eases, it is expected to lower costs and improve the availability of new cars, subsequently impacting the Skoda Enyaq’s asking price in the market.

Changes in Second-Hand Electric Vehicle Demands

A shift in consumer interest toward new, in-stock electric vehicles is resulting in a noticeable transformation in second-hand vehicle demands, as the availability of new models becomes a tangible reality. This shift may lead to a more moderate decline in the Skoda Enyaq’s value as the market adjusts.

The wave of change across the electric vehicle sector is painting a complex picture for the future of EV depreciation. Below is a table that encapsulates the juxtaposition of market dynamics on the resale value of the Skoda Enyaq:

| Market Factor | Impact on Skoda Enyaq Resale Value |

|---|---|

| Extended Lead Times | Previously increased second-hand value |

| Resolution of Chip Shortage | Potential reduction in new and used car prices |

| In-stock Availability | Greater negotiation leverage for buyers |

| Changes in EV Demand | Possible stabilization or decrease in depreciation rate |

As the electric vehicle marketplace progresses amidst these pivotal changes, discerning consumers and stakeholders must remain vigilant. Taking into account these evolving market dynamics will be critical for those looking to invest in models like the Skoda Enyaq, a vehicle at the forefront of the electrification wave.

Skoda Enyaq Value Depreciation: What Buyers Should Know

When stepping into the market of electric vehicles (EVs), particularly models like the Skoda Enyaq, prospective buyers should be cognizant of Skoda Enyaq value depreciation and its nuances compared to traditional internal combustion engine vehicles. While all vehicles are subject to depreciation, EVs have historically experienced rapid value drops primarily due to uncertainties surrounding their technology and resale markets. However, times are changing, and with it, the Skoda Enyaq is revealing a different value retention narrative.

Depreciation—the disparity between a car’s purchase price and its later resale value—can be daunting for any car owner. However, with maintaining car value in mind, the Enyaq, like many of its contemporary EV counterparts, benefits from emerging factors that potentially slow its depreciation curve. Key among these is a heightened demand for electric transportation solutions, fueled by eco-conscious consumer behaviors, expanding charging infrastructure, and government policies incentivizing EV adoption.

Environmental policies, such as the introduction of ultra-low emission zones, coupled with rising fuel prices, have prompted an uptick in EV desirability. These factors may contribute positively to the Skoda Enyaq’s resale value, making it a more appealing option for those seeking a vehicle with lasting value. It’s essential for buyers to pay heed to these vehicle resale insights, shaping their purchase decisions and protecting their investments.

Take, for instance, the recent relaxation of the once dire automotive chip shortage, a crux for modern EV manufacturing, including that of the Skoda Enyaq. This easing potentially translates into a decrease in new car prices and, consequently, may adjust pre-owned vehicle price tags downwards. Nonetheless, the EV market’s resilience has revealed an encouraging trend. The Skoda Enyaq’s enhanced range, modern amenities, and technological advancements position it prominently as a capable contender for those aiming to maximize resale value.

To provide a clearer picture of this landscape, let’s consider the broader context with a closer examination of market indicators:

| Market Trend | Impact on Skoda Enyaq Value |

|---|---|

| Increased EV Demand | Improvement in Resale Outlook |

| Rising Fuel Costs | Boosts Attractiveness of EVs |

| Technological Maturation | Lessens Depreciation Speed |

| Environmental Regulation | Enhances EV Residual Value |

Prospective Skoda Enyaq owners need to stay informed about the current EV climate, which, due to the factors mentioned, hints at signs of maintaining car value more effectively than ever before. Consistently utilizing vehicle resale insights positions the well-informed buyer to potentially benefit from steadier Skoda Enyaq value depreciation rates, counteracting the traditional woes of new car investments.

How Electric Vehicles Fare in Resale: Skoda Enyaq Resale Value Insights

The electric vehicle (EV) market is experiencing a surge in popularity, sparking an interest in evaluating models like the Skoda Enyaq for their potential resale value. With consumer focus shifting towards sustainable and eco-friendly transportation options, it’s imperative to gauge how EVs stack up in terms of retaining value over time. This section delves into the factors influencing the Skoda Enyaq resale value and explores the burgeoning trends in electric vehicle resale markets.

Comparative EV Resale Values

In a rapidly expanding market, the Skoda Enyaq has emerged as an emblem of practicality and innovation, promising to join the ranks of EVs known for robust residual values. Historically, electric vehicles did not fare as well in resale markets, but this trend is being reversed by high-end EVs such as those from Tesla and Mercedes-Benz. As electric vehicles become more mainstream, the Skoda Enyaq is positioned to potentially emulate this trend. An examination of the latest electric vehicle resale trends reveals:

| Brand | Model | Estimated Resale Value Retention |

|---|---|---|

| Mercedes-Benz | EQC | 65% |

| Tesla | Model S Performance Ludicrous | 60% |

| Porsche | Taycan | 77% |

The promising figures suggest a healthy outlook for the Skoda Enyaq resale value, potentially offering a competitive advantage to its owners in a market that values the luxury and innovation these brands represent.

Role of Emission Zones and Fuel Prices

As urban centers worldwide continue to enforce ultra-low emission zones, the desirability of EVs, including the Skoda Enyaq, is increasing. These emission zones are designed to curb pollution and create cleaner cities, prompting drivers to consider EVs as a necessity rather than a luxury. The escalating fuel prices further tip the scale in favor of electric vehicles. With both fuel economy and environmental regulations becoming pivotal concerns for modern consumers, we can anticipate:

- Heightened demand for models like the Skoda Enyaq, well-suited for emission-controlled areas

- A continued upward trend in electric vehicle resale values, driven by restrictive policies

These factors not only establish the Skoda Enyaq as an economically savvy choice but also solidify its stature within electric vehicle resale trends, potentially ensuring that owners see a slower depreciation and healthier return on investment.

Skoda Enyaq Depreciation Rate Compared to Combustion and Hybrid Vehicles

The electric vehicle (EV) market is evolving, and with it, the Skoda Enyaq depreciation rate is emerging as a testament to the value retention of EVs over their combustion and hybrid counterparts. Understanding the depreciation rates among these vehicle types helps consumers make informed decisions when purchasing or investing in a new car. The Enyaq, Skoda’s foray into the electric SUV segment, stands as an intriguing case study for depreciation patterns in the modern automotive landscape.

Comparing EVs, Petrol, Diesel, and Hybrid Depreciation Statistics

When evaluating Skoda Enyaq depreciation rate against traditional combustion vehicle depreciation, it becomes clear that the Enyaq is placed favorably. This is a reflection of a broader trend where EVs outperform petrol and diesel vehicles in terms of holding their value over time. Notably, the ban on the sale of new combustion-engined vehicles is looming, making EVs like the Skoda Enyaq a more prudent choice for future-proofing against depreciation.

Similarly, hybrid vehicle resale value remains strong in the current market; however, as the world pivots more decisively towards fully electric vehicles, hybrids may start to see a shift in their depreciation rates. Innovations in EV technology and the rising implementation of environmental policies are shaping consumer preferences, turning the tide in favor of vehicles like the Skoda Enyaq.

The table below showcases a comparison of the average depreciation rates for electric, petrol, diesel, and hybrid vehicles:

| Vehicle Type | Average First-Year Depreciation | 3-Year Depreciation Projection |

|---|---|---|

| Electric (EV) | 21% | 39% |

| Petrol | 29% | 49% |

| Diesel | 32% | 52% |

| Hybrid | 25% | 41% |

Influence of Upcoming Legislation on Vehicle Values

Anticipating the Skoda Enyaq depreciation rate and that of other vehicle types requires an understanding of the incremental changes in legislation. The inevitable phase-out of combustion vehicles is forecasted to uplift the resale values of electric cars. As governments actively incentivize shifts to more eco-friendly rides, EVs such as the Skoda Enyaq benefit from a surge in consumer interest, leading to a more gradual depreciation curve compared to their petrol and diesel counterparts.

This regulatory landscape not only sets the stage for a vibrant EV secondary market but also impacts the long-term financial planning for both individual consumers and fleets. Whether considering the resale value for private resale or commercial purposes, adjusting to these legislative changes is pivotal.

An intricate interplay of technology, market forces, and legislation is, therefore, sculpting the depreciation discourse, with electric models like the Skoda Enyaq poised to lead the way in value maintenance. With the automotive era gearing up for greener horizons, those seeking vehicles with a lower depreciation rate are increasingly turning their eyes towards electric and plug-in hybrid options, with the Enyaq offering an attractive blend of technology and sustainability.

The Financial Benefits of Leasing a Skoda Enyaq

Leasing has increasingly become a popular option for drivers interested in the latest electric vehicles, offering a compelling financial alternative to outright ownership. With the Skoda Enyaq, drivers gain access to a sophisticated electric vehicle with the added advantage of budget-friendly leasing solutions. Let’s delve into how leasing a Skoda Enyaq can align with financial planning strategies and provide considerable Skoda Enyaq leasing benefits.

Calculating Payments Based on Depreciation Projections

When you lease a Skoda Enyaq, the monthly payments are intricately linked to the vehicle’s depreciation projections. Unlike purchasing, where you bear the full cost of the vehicle’s depreciation over time, leasing confines your financial commitment to only the portion of the car’s value that is expected to depreciate during the lease term. Engaging in detailed financial planning can help you predict these costs with greater accuracy. Here’s how the numbers can work in your favor:

- Monthly lease payments are often lower, as they cover only the estimated depreciation, not the entire vehicle value.

- Leasing deals often incorporate warranty coverage for the lease duration, reducing maintenance costs.

- Predictable monthly expenses aid in personal or business financial planning.

Leasing Versus Ownership: Depreciation Risks

Consideration of depreciation risks is a crucial aspect of the decision-making process for potential Skoda Enyaq drivers. While purchasing a vehicle means wrestling with the uncertain depreciation projections, leasing sidesteps this issue. As an Enyaq lessee:

- You avoid the risk of unexpected depreciation if newer, more advanced models cause your vehicle’s value to plummet.

- Leasing enables you to transition to newer technology seamlessly at the end of your lease term without resale hassles.

- Flexibility in lease terms and conditions can cater to changing technological landscapes and personal circumstances.

In essence, the Skoda Enyaq leasing benefits aren’t just about enjoying a premium electric vehicle; they’re integral to financial planning, ensuring you stay ahead with up-to-date features while circumventing the decline in value that affects all vehicles.

Analyzing Skoda Enyaq Depreciation Factors

Investigating the depreciation factors of the Skoda Enyaq reveals key insights into its long-term value retention. Intertwining technology with market demands, the Skoda Enyaq has created its own niche in the realm of electric vehicles (EVs), commanding attention from potential buyers and enthusiasts analyzing its resale worth.

Effect of Range and Charging Capabilities on Value

The EV range and charging capabilities are paramount factors that can drive the Skoda Enyaq’s depreciation rate. An EV’s range anxiety is a primary concern for consumers, with a direct correlation between range capabilities and perceived value. The Enyaq’s impressive range not only stands as a testament to its engineering but also boosts consumer confidence, which in turn, could have a positive effect on its value in the second-hand EV market. Rapid charging capabilities further enhance this perception, promising convenience and reduced downtime—an attractive proposition for the resale buyer.

How In-Car Technology Influences Resale Prices

As we navigate the interconnected world of today, in-car technology emerges as a significant Skoda Enyaq depreciation factor. Modern buyers view in-car technology not as a luxury but as a necessity. The integration of advanced connectivity features and the ability to receive over-the-air updates positions the Enyaq favorably against its competitors. This digital savviness has a measurable impact on the Skoda Enyaq’s appeal in the resale market, offering the potential for a slower depreciation rate by maintaining the vehicle’s relevance and desirability over time.

- Wireless connectivity and compatibility with mobile devices.

- Advanced driver assistance systems enhancing safety and comfort.

- Over-the-air software updates keeping the vehicle current.

These in-car technology impacts are more than mere features; they form the Enyaq’s core value proposition that could command a higher price tag even years down the line. With ongoing advancements in vehicle technology, the value of the Skoda Enyaq may well be anchored by its technological prowess and foresight.

Detailed Skoda Enyaq Depreciation Analysis Over Time

Electric vehicles (EVs) are known for their innovative features and positive environmental impact, yet prospective and current EV owners often reflect on long-term ownership costs. Among these concerns, the Skoda Enyaq’s value retention is a focal point. This detailed depreciation analysis offers valuable insights for those considering the long-term financial implications of owning this advanced electric SUV.

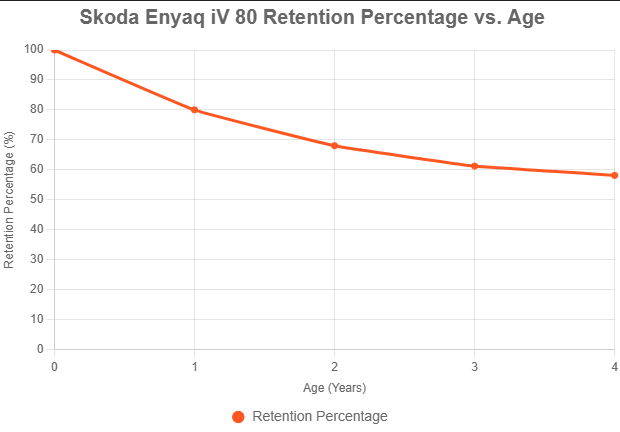

Year-by-Year Depreciation Trends

Understanding the Skoda Enyaq’s depreciation requires examining annual value trends. The Skoda Enyaq, like any vehicle, faces a significant reduction in value during its initial years. The annual value trends, showcased in the table below, outline the typical depreciation path for this electric model over time.

| Year | Initial Value | Estimated Annual Depreciation | Residual Value |

|---|---|---|---|

| Year 1 | $30,000 | 25% | $22,500 |

| Year 2 | $22,500 | 18% | $18,450 |

| Year 3 | $18,450 | 15% | $15,682.50 |

| Year 4 | $15,682.50 | 13% | $13,643.78 |

| Year 5 | $13,643.78 | 10% | $12,279.40 |

Long-Term Financial Implications for Owners

The depreciation of the Skoda Enyaq reflects a key aspect of long-term ownership costs. Owners need to be aware of the financial implications over the lifespan of their vehicle. While the Skoda Enyaq is subject to the traditional downturn in value, the Skoda Enyaq depreciation analysis indicates that the rate of loss stabilizes as the vehicle ages. This pattern can inform decisions regarding the optimal time to sell or trade in the Enyaq, with the aim to maximize its resale value and reduce financial outlay.

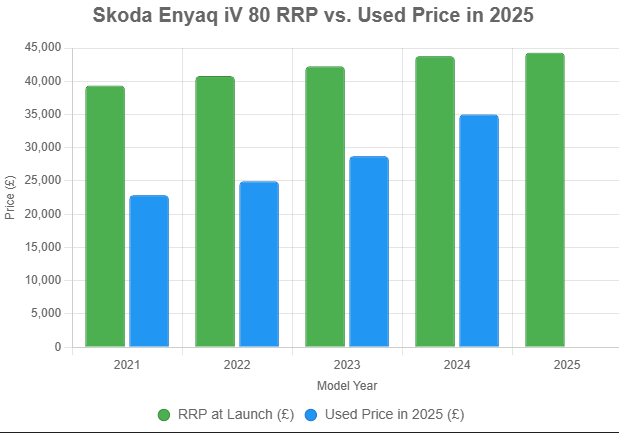

Skoda Enyaq Price Drop: Predictions and Reality

The realm of electric vehicles (EVs) is a vibrant market of innovation and anticipation, where predicting values and resale prices is an invigorating challenge. Recent market observations have highlighted a fascinating disparity between predictions regarding Skoda Enyaq price drop expectations and the actual resale values experienced by owners. This section explores the intricate dance between anticipated depreciation and the robust retention of value witnessed in practice.

Market Predictions Versus Actual Resale Figures

Once predicted to take a steep dive post-purchase, the Skoda Enyaq has defied assumptions by maintaining a stronger-than-expected hold on its worth in the resale market. Analysts did not foresee the steadfast resilience of EV resale values, and the Enyaq has exemplified this stability through its actual resale values, which have stayed relatively buoyant. Key factors influencing this phenomenon include the expansion of public charging infrastructure, pertinent regulatory incentives, and surging consumer interest in environmentally-friendly transport options.

Case Studies of Skoda Enyaq Ownership Experience

Case studies of actual Skoda ownership experiences reveal a compelling narrative that contrasts starkly with the bleak depreciation once warned of by skeptics. Enyaq owners have recounted instances of trading their vehicles back to dealers at a premium, prizing the model for its robust features such as the esteemed iV80 Lounge equipped with a heat pump and tow bar, thus suggesting that the Enyaq can uphold its value remarkably well—even after years of service or nearing the end of a Personal Contract Purchase (PCP) agreement.

| Ownership Experience | Resale Outcome |

|---|---|

| Early trade-in of Enyaq | Sold at a premium above initial value |

| PCP end-of-contract scenario | Option to sell back for profit or elegantly exit the agreement |

| Utilizing high-end Enyaq features (e.g., iV80 Lounge) | Increase in trade-in leverage and value |

These insights not only shine a light on the Skoda Enyaq price drop predictions but also illuminate the potentials of investing in this vibrant EV contender. Navigating the complex but rewarding roads of Skoda Enyaq ownership can indeed be a journey marked by endurance of value and a rewarding ownership experience.

Conclusion

In this comprehensive exploration of the Skoda Enyaq’s depreciation, we’ve unpacked the various forces shaping its resale value—insights integral for maximizing vehicle value and investment optimization. Electric vehicles are undeniably en vogue, and the Enyaq is perfectly poised to benefit from this momentum. From technological advancements to burgeoning market demands, a constellation of factors is coalescing to ensure that the Skoda Enyaq maintains a compelling proposition in the EV arena.

Summarizing Skoda Enyaq’s Depreciation

The Skoda Enyaq depreciation summary reveals that while it aligns with common car value trends, its depreciation rate is mitigated by the strength of the electric vehicle movement and its technological prowess. With growing environmental consciousness and policy changes accelerating the shift toward EVs, the Enyaq stands out with slower depreciation and promising residual values. These trends are vital indicators for prospective buyers and industry experts alike, reaffirming the Enyaq’s position as a smart investment in the shifting sands of the automotive landscape.

Final Thoughts on Vehicle Value Retention

To safeguard one’s financial interests in the volatile world of car ownership, a nuanced understanding of electric vehicle depreciation is paramount. The Skoda Enyaq demonstrates that vehicle value retention is no longer just about age and mileage, but increasingly about how well an EV responds to environmental policies, technological advancement, and consumer expectations. In conclusion, the Enyaq offers a favorable narrative for those keen on investment optimization in the burgeoning EV market.

FAQ

What factors influence Skoda Enyaq’s depreciation rate?

Factors affecting the Skoda Enyaq’s depreciation rate include the overall demand for electric vehicles, market saturation, technological advancements, battery longevity, model updates, government incentives for EVs, and the broader economic climate. Vehicle condition and mileage also play a significant role.

How do recent market dynamics impact Skoda Enyaq’s depreciation?

The recent chip shortage led to elevated second-hand prices and extended lead times, which are now normalizing. This normalization is resulting in increased availability of new models which, in turn, might suggest a future decrease in the Skoda Enyaq’s second-hand value as more options enter the market.

What should buyers know about Skoda Enyaq’s value depreciation?

Buyers should be aware that like all vehicles, Skoda Enyaq’s value depreciates over time. However, with the increasing desirability of EVs and government measures favoring electric mobility, the Enyaq may hold its value better than expected, particularly in the coming years.

How do electric vehicles like the Skoda Enyaq fare in resale compared to traditional vehicles?

Electric vehicles, including the Skoda Enyaq, tend to have better resale values than traditional petrol or diesel vehicles. The growing infrastructure for electric vehicles, along with the rising cost of fuel, generally makes EVs more appealing and can support stronger residual values.

How does the Skoda Enyaq’s depreciation compare to that of combustion and hybrid vehicles?

The Skoda Enyaq, as an electric vehicle, often experiences lower depreciation rates when compared to combustion vehicles and, in some cases, hybrids. This is partly due to impending legislation targeting the reduction of fossil-fuel vehicles, which increases the appeal of fully electric vehicles.

Are there financial benefits to leasing a Skoda Enyaq instead of buying?

Yes, leasing a Skoda Enyaq can offer substantial financial benefits. Lease payments consider the car’s projected depreciation, and users can regularly upgrade to newer models. This mitigates the risk of unexpected depreciation, which can be particularly advantageous with the evolving technology of EVs.

What Skoda Enyaq features affect its resale value?

The Skoda Enyaq’s resale value can be influenced by its range, charging capabilities, in-car technological advancements, and the inclusion of features like rapid charging. These attributes enhance the car’s desirability and may contribute to a slower depreciation rate.

Can you provide an analysis of Skoda Enyaq’s depreciation over time?

Skoda Enyaq is likely to experience a steep depreciation initially, which is common for new vehicles, but this should stabilize in the years following. Understanding the annual depreciation trends helps owners decide the optimal time to sell or trade-in the vehicle.

How accurate were market predictions regarding Skoda Enyaq’s price drop?

Market predictions did not fully anticipate the current stability of the Skoda Enyaq’s resale value. Real figures indicate stronger than expected value retention, suggesting that the Enyaq can be a solid investment for the future.