The arrival of the BMW iX1 marked a significant moment for the Australian premium electric vehicle (EV) market. As the entry point to BMW’s all-electric SUV family, it promised the brand’s signature blend of luxury, performance, and technology in a practical, compact package. However, for savvy buyers and current owners, the most pressing question isn’t just about driving dynamics or battery range—it’s about the long-term cost of ownership, with depreciation being the single largest factor.

This article delves deep into the financial performance of the BMW iX1 in Australia, using real-world market data to analyse its value retention since its launch. We will explore year-on-year trends, benchmark it against key rivals like the Tesla Model Y, and provide a data-driven forecast to help you understand what your investment might be worth in the years to come.

The iX1 in the Australian Market: A Premium Contender in a Tough Arena

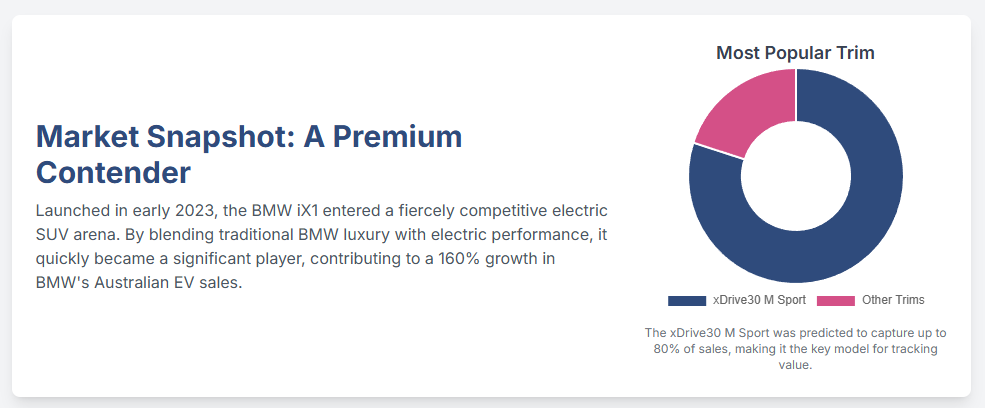

The BMW iX1 (U11) officially landed on Australian shores in early 2023, entering a fiercely competitive arena. Positioned against the likes of the Tesla Model Y, Volvo XC40 Recharge, and Mercedes-Benz EQA, the iX1 aimed to capture buyers seeking a premium EV experience without the unconventional styling of some competitors.[5, 6] By sharing its platform and design with the popular petrol-powered X1, BMW offered a familiar and comfortable transition into electric mobility for its loyal customer base.

The initial launch focused on the powerful dual-motor, all-wheel-drive iX1 xDrive30, offered in both ‘xLine’ and the more popular ‘M Sport’ trims. This analysis will focus on the iX1 xDrive30 M Sport, which industry experts predicted would command up to 80% of sales, making it the most representative model for tracking value.

BMW’s pricing strategy for the iX1 has been dynamic. After an initial announcement, the launch price for the 2023 xDrive30 was adjusted upwards to $84,900 plus on-road costs, a figure that has since climbed to $86,800 for the 2024 and 2025 models.[1, 7, 11] In a noteworthy move, some features like the premium sound system and panoramic sunroof were shifted from standard to an optional package early on, highlighting the importance of checking the specific build of any used model.[1]

The model has proven to be a success for the brand, with around 2,500 iX1s sold in 2024, contributing significantly to BMW’s impressive 160% growth in EV sales in Australia

Analysing the Numbers: How Fast Does the iX1 Depreciate?

To understand the real-world depreciation of the iX1, we have analysed data from industry valuation guides like(https://www.redbook.com.au/) and Australia’s largest online car marketplace, Carsales.com.au. By comparing the original Manufacturer’s Suggested Retail Price (MSRP) to current used market values (as of mid-2025), we can calculate the vehicle’s value retention.

The results reveal a fascinating story.

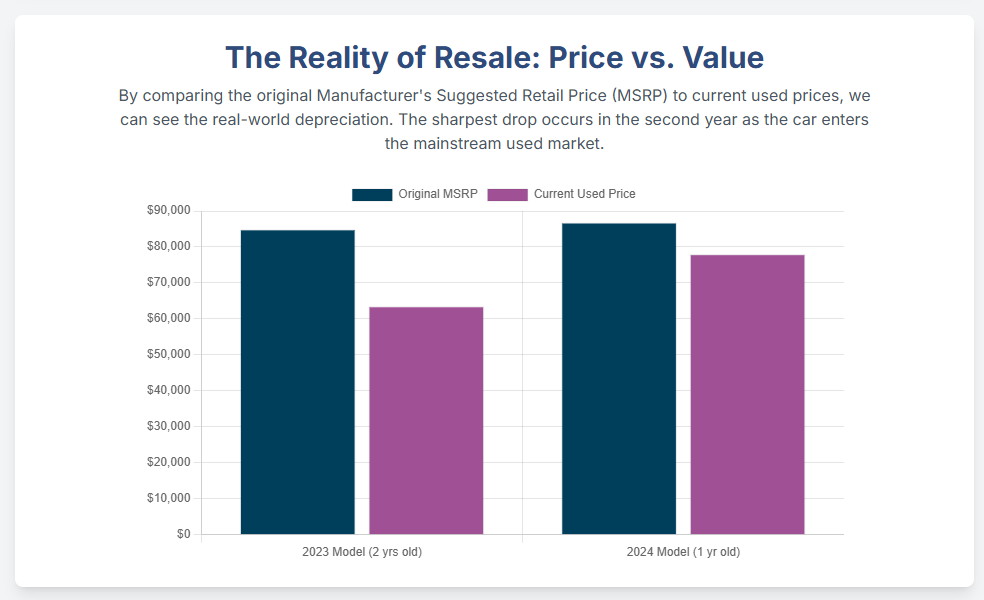

- 2023 BMW iX1 xDrive30 M Sport (Age: ~2 years): With an initial MSRP of $84,900, this model has an average current used price of approximately $63,500. This translates to a total depreciation of 25.2%, or a retained value of 74.8% after two years.

- 2024 BMW iX1 xDrive30 M Sport (Age: ~1 year): With an MSRP of $86,800, one-year-old examples are selling for around $78,000. This indicates a first-year depreciation of just 10.1%.

While the 10% first-year figure looks incredibly strong, it’s somewhat misleading. The high value of “nearly new” models is propped up by buyers willing to pay a premium for immediate availability over ordering a brand new car and absorbing the hefty on-road costs. The true depreciation cliff appears in the second year, where the car loses an additional 15% of its value as it enters the mainstream used market. This pattern is crucial for prospective buyers to understand: the biggest initial hit isn’t in the first year, but the second.

The table below summarises the current depreciation status.

Table 1: Current Depreciation of BMW iX1 xDrive30 M Sport by Model Year (as of mid-2025)

| Model Year | Age (Years) | MSRP (AUD) | Avg. Current Used Price (AUD) | Depreciation (AUD) | Depreciation (%) | Retained Value (%) |

| 2023 | ~2 | $84,900 | $63,500 | $21,400 | 25.2% | 74.8% |

| 2024 | ~1 | $86,800 | $78,000 | $8,800 | 10.1% | 89.9% |

This is visually represented in the chart below, showing the gap between the new price and the current used price for each model year.

(Chart) MSRP vs. Current Used Price for BMW iX1 xDrive30 M Sport

A bar chart comparing the taller MSRP bar to the shorter Current Used Price bar for both the 2023 and 2024 model years, visually demonstrating the dollar-value depreciation.

The Perfect Storm: Why Australian EVs are Depreciating Faster

The iX1’s value doesn’t exist in a vacuum. The entire Australian EV market is currently a challenging environment for resale values, creating a “perfect storm” of depreciation. According to a 2024 industry report, one-year-old EVs lost an average of 25% of their value, compared to just 1.7% for hybrids.[24, 28] There are three key reasons for this:

- Aggressive Price Cuts: Market leader Tesla has repeatedly slashed prices on new models. When the price of a new Tesla Model Y drops by thousands, it instantly lowers the value ceiling for every comparable used EV on the market, including premium offerings from BMW.[23, 24]

- Rapid Technological Advance: EV technology is evolving at a blistering pace. A two-year-old model’s range and charging speed can seem outdated compared to the latest releases, accelerating what experts call “technology-driven obsolescence”.[25]

- Shifting Government Incentives: The phasing out of state-level EV purchase rebates and changes to the federal Fringe Benefits Tax (FBT) exemption have altered market dynamics, primarily benefiting new car buyers and softening demand in the used sector.[26, 27]

How Does the iX1 Compare to Competitors?

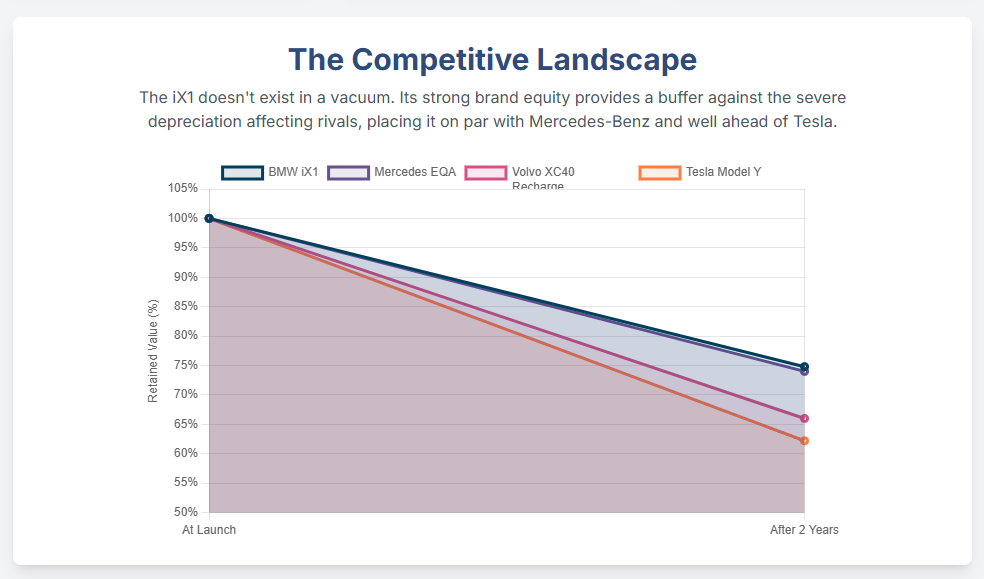

Given this tough market, how does the iX1 stack up against its direct rivals? Our analysis shows it’s carving out a strong position.

- vs. Tesla Model Y: The iX1 is a clear winner here. The Tesla Model Y, while a top seller, has been subject to significant price cuts, leading to severe depreciation. Data suggests a two-year-old Model Y can lose around 38% of its value—considerably more than the iX1’s 25%.[29, 20, 30]

- vs. Mercedes-Benz EQA: The battle is much closer with its direct German rival. The Mercedes EQA shows a two-year retained value of approximately 74%, making its performance almost identical to the iX1.[32]

- vs. Volvo XC40 Recharge: The stylish Swede sits between the Germans and the Tesla, with data suggesting a two-year retained value of around 66%.[31]

This indicates that the premium badge and perceived build quality of BMW and Mercedes-Benz are providing a significant buffer against the market’s worst depreciation. Buyers in the used market are demonstrating a preference for the established European luxury brands.

The following chart plots the value retention of the iX1 against its key competitors, illustrating its strong position.

A line graph showing four distinct curves. The BMW iX1 and Mercedes-Benz EQA lines track closely together at the top. The Volvo XC40 Recharge line sits below them, and the Tesla Model Y line shows the steepest decline at the bottom.

Looking Ahead: A 5-Year Depreciation Forecast

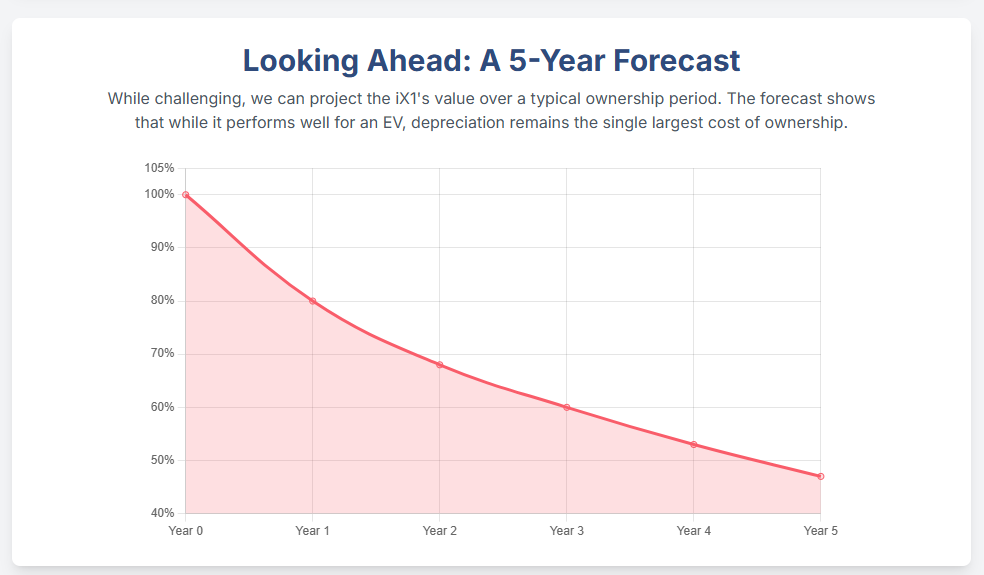

Predicting the future in the fast-moving EV market is challenging, but by benchmarking the iX1 against market trends, we can create a data-driven forecast. Our projection indicates that the iX1 will continue to hold its value better than many competitors, but will still experience significant depreciation.

The table below outlines the projected value of a 2024 iX1 xDrive30 M Sport over a five-year ownership period.

Table 2: Projected 5-Year Depreciation Schedule for a BMW iX1 xDrive30 M Sport (2024 Model Year)

| Age (Years) | Calendar Year End | Projected Retained Value (%) | Projected Used Value (AUD) |

| 1 | 2025 | ~80% | ~$69,440 |

| 2 | 2026 | ~68% | ~$59,024 |

| 3 | 2027 | ~60% | ~$52,080 |

| 4 | 2028 | ~53% | ~$46,004 |

| 5 | 2029 | ~47% | ~$40,796 |

This forecast suggests that an owner can expect their iX1 to be worth just under half of its purchase price after five years. The biggest risks to this forecast are further aggressive price cuts from competitors and major breakthroughs in battery technology that could make the iX1’s 400km range seem outdated.[12]

The Verdict: Is the BMW iX1 a Smart Buy?

The data paints a clear picture. The BMW iX1 is proving to be a relatively “safe harbour” in the turbulent premium EV market. Its strong brand equity provides a valuable buffer against the extreme depreciation affecting some competitors, particularly the Tesla Model Y. For buyers who value the traditional premium experience, build quality, and brand heritage, the iX1 holds its value well within its class.

However, it’s crucial to acknowledge that depreciation is still the single largest cost of owning an iX1. The projected loss of over 50% in five years is a substantial financial consideration and is likely higher than what would be experienced with its petrol-powered sibling, the BMW X1.

Ultimately, the BMW iX1 represents a trade-off. It offers a lower-risk entry into premium EV ownership than many alternatives, but it is not immune to the powerful market forces of technological advancement and price competition. For the discerning buyer, it is a choice that balances the modern appeal of electric driving with the enduring value of a premium German badge.