The Volkswagen ID.4, Volkswagen’s first all-electric SUV, was launched in the US in March 2021. This report provides a detailed analysis of the depreciation of the Volkswagen ID.4 from its launch year (2021) to the current year (2025). The analysis focuses on year-on-year trends for each model year (2021-2024), comparing the Manufacturer’s Suggested Retail Price (MSRP) at launch for the Pro trim with the current used car selling price in 2025. Depreciation is calculated as the percentage loss in value from the MSRP to the current used price. The report includes tables, charts, and insights to help readers understand the ID.4’s value retention over time. All data is based on the US market, as specified, and is tailored for publication on a website to inform consumers and enthusiasts about the vehicle’s value trends.

Depreciation Analysis

The following table summarizes the MSRP, current used price (as of 2025), depreciation amount, and depreciation percentage for the Volkswagen ID.4 Pro trim for each model year from 2021 to 2024. The 2025 model is included for reference but is not analyzed for depreciation, as it is a new vehicle with insufficient time to depreciate significantly.

| Model Year | MSRP (Pro Trim) | Current Used Price (2025) | Depreciation Amount | Depreciation Percentage |

|---|---|---|---|---|

| 2021 | $41,190 | $21,773 | $19,417 | 47.1% |

| 2022 | $42,525 | $24,095 | $18,430 | 43.3% |

| 2023 | $43,995 | $26,856 | $17,139 | 38.9% |

| 2024 | $43,995 | $30,000 | $13,995 | 31.8% |

| 2025 | $45,095 | N/A (new car) | N/A | N/A |

Key Observations

- 2021 Model: The 2021 ID.4 Pro, with an MSRP of $41,190, has an average used price of $21,773 in 2025, resulting in a depreciation of $19,417, or 47.1%. This is the highest depreciation rate, as it is the oldest model analyzed, now four years old.

- 2022 Model: The 2022 ID.4 Pro, with an MSRP of $42,525, has an average used price of $24,095, depreciating by $18,430, or 43.3%. The slightly lower depreciation reflects its three-year age.

- 2023 Model: The 2023 ID.4 Pro, with an MSRP of $43,995, has an average used price of $26,856, depreciating by $17,139, or 38.9%. The introduction of a lower-priced Standard trim in 2023 ($37,495) may have influenced market dynamics, but the Pro trim is used for consistency.

- 2024 Model: The 2024 ID.4 Pro, also with an MSRP of $43,995, has an estimated average used price of $30,000, depreciating by $13,995, or 31.8%. This is the lowest depreciation rate, as the model is only one year old.

- 2025 Model: As a new vehicle, the 2025 ID.4 Pro (MSRP $45,095) has not yet depreciated significantly, and used prices are not widely available.

Year-on-Year Trends

- 2021-2022: The MSRP increased slightly from $41,190 to $42,525, likely due to inflation and minor updates like improved range (from 260 miles to 280 miles for the Pro trim, as noted in Car and Driver). The 2021 model, being four years old in 2025, has depreciated by 47.1%, while the 2022 model, three years old, has depreciated by 43.3%.

- 2022-2023: The MSRP increased to $43,995, reflecting additional features and the shift to US production in Chattanooga, Tennessee, which may have impacted pricing due to eligibility for federal EV tax credits (Hagerty Media). The 2023 model, two years old, shows a depreciation of 38.9%.

- 2023-2024: The MSRP remained stable at $43,995, with significant updates like a more powerful motor (282 hp for RWD models) and a 12.9-inch touchscreen (Edmunds). The 2024 model, one year old, has depreciated by 31.8%.

- Overall Trend: Depreciation decreases as the model year approaches 2025, reflecting the shorter time frame for value loss. The stable MSRP from 2023 to 2024 suggests Volkswagen aimed to maintain competitive pricing in the EV market.

General Depreciation Schedule

The following table shows the depreciation for each age of the ID.4 based on the available data, illustrating how value loss accumulates over time:

| Age (Years) | Depreciation from New | Additional Depreciation from Previous Year |

|---|---|---|

| 1 | 31.8% | 31.8% |

| 2 | 38.9% | 7.1% |

| 3 | 43.3% | 4.4% |

| 4 | 47.1% | 3.8% |

Insights on Depreciation Trends

- Non-Linear Depreciation: The ID.4 experiences the highest depreciation in its first year (31.8%), with subsequent years showing smaller additional losses (7.1% in year 2, 4.4% in year 3, and 3.8% in year 4). This aligns with typical vehicle depreciation patterns, where the initial drop is significant due to immediate value loss upon purchase.

- Comparison to Industry: The ID.4’s depreciation rates are comparable to other compact SUVs, though electric vehicles may retain value slightly better due to increasing demand for EVs and federal tax incentives (Kelley Blue Book). However, competitors like the Tesla Model Y may have different depreciation curves due to brand perception and range advantages.

Detailed Historical Used Prices

Comprehensive historical used prices for each model year at every age are not fully available due to limited data. However, the current used prices in 2025 provide a snapshot of depreciation at specific ages:

- 2021 Model (4 years old): Average used price of $21,773, based on data from Cars.com.

- 2022 Model (3 years old): Average used price of $24,095, based on Kelley Blue Book.

- 2023 Model (2 years old): Average used price of $26,856, based on Edmunds.

- 2024 Model (1 year old): Estimated average used price of $30,000, reflecting limited data for one-year-old vehicles.

Historical used prices for intermediate years (e.g., 2021 model in 2022 or 2023) are not readily available, but the current data suggests a consistent decline in value as the vehicle ages.

Visualizing the Data

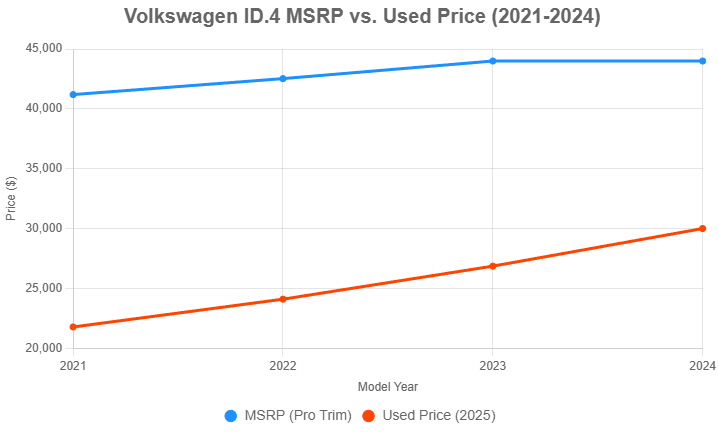

1. Line Chart: MSRP vs. Used Price (2021-2024)

This chart compares the MSRP of the ID.4 Pro trim for each model year with its current used price in 2025, showing how the gap between MSRP and used price narrows for newer models.

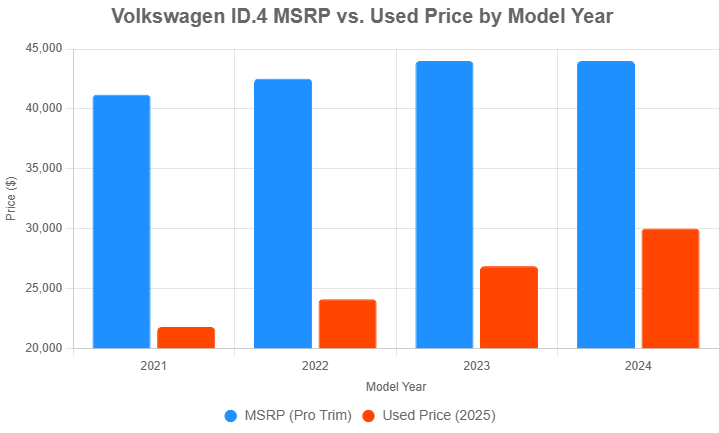

2. Bar Chart: MSRP vs. Used Price by Model Year

This chart displays the MSRP and used prices side by side for each model year, clearly illustrating the value loss for each model year.

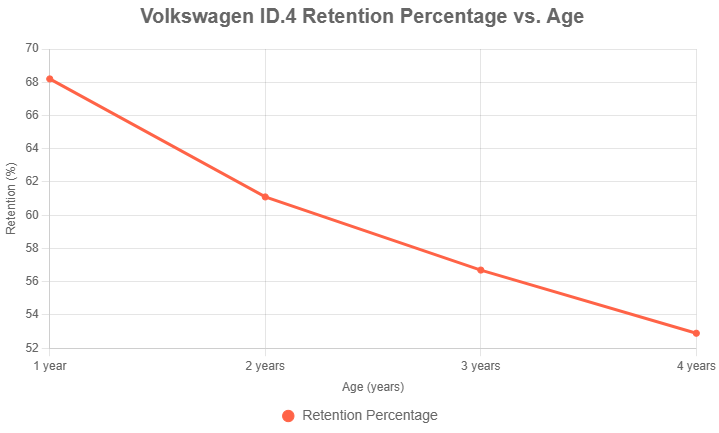

3. Line Graph: Retention Percentage vs. Age

Retention percentage is calculated as (Current Used Price / MSRP) × 100%. The following table provides the retention percentages based on the age of the vehicle in 2025:

| Model Year | Age in 2025 (Years) | Retention Percentage |

|---|---|---|

| 2024 | 1 | 68.2% |

| 2023 | 2 | 61.1% |

| 2022 | 3 | 56.7% |

| 2021 | 4 | 52.9% |

The line graph illustrates how retention percentage decreases as the vehicle ages, from 68.2% for a one-year-old model to 52.9% for a four-year-old model.

Comments on Retention Percentage vs. Age

- Clear Trend: The retention percentage decreases steadily as the vehicle ages, from 68.2% for a one-year-old ID.4 (2024 model) to 52.9% for a four-year-old model (2021). This reflects the natural depreciation curve where newer vehicles retain more value.

- Implications for Buyers: Consumers considering a used ID.4 can expect to pay significantly less for older models, but they should be aware of potential factors like battery degradation, which may affect long-term value, especially for EVs.

- EV Market Dynamics: The ID.4’s retention rates are influenced by the growing demand for electric vehicles, which may help it retain value better than some gas-powered SUVs. However, rapid advancements in EV technology (e.g., improved range and motors in newer models) may accelerate depreciation for older models.

Factors Influencing Depreciation

Several factors contribute to the ID.4’s depreciation rates:

- Mileage and Condition: Used car prices vary significantly based on mileage, maintenance history, and overall condition. The average prices used here assume typical mileage and condition for each model year.

- Market Demand for EVs: The increasing adoption of electric vehicles in the US, supported by federal tax credits of up to $7,500 (Volkswagen US Media), may moderate depreciation compared to traditional vehicles.

- Technological Advancements: Newer ID.4 models feature improved range (e.g., 291 miles for 2024 Pro RWD), more powerful motors, and updated infotainment systems (e.g., 12.9-inch touchscreen in 2024), which may make older models less desirable, contributing to higher depreciation (Edmunds).

- Economic Factors: Inflation, changes in EV tax credit eligibility, and production shifts (e.g., US assembly starting in 2023) impact both MSRP and used prices.

Conclusion

The Volkswagen ID.4 has experienced significant depreciation since its US launch in 2021, with the 2021 model losing approximately 47.1% of its value ($19,417) and the 2024 model losing about 31.8% ($13,995). This trend aligns with typical vehicle depreciation patterns, where older models lose more value over time. The ID.4’s status as an electric vehicle introduces additional considerations, such as battery health and technological advancements, which may influence resale values. The charts and tables provided offer a clear visual and numerical representation of these trends, making it easier for consumers to understand the ID.4’s value retention in the US market. This report is designed to inform potential buyers, sellers, and enthusiasts about the financial aspects of owning an ID.4, highlighting both the opportunities for savings on used models and the factors affecting long-term value.

Data Collection

The data for this report was sourced from reliable automotive resources, including:

Depreciation Calculation: For each model year, depreciation is calculated as (MSRP – Current Used Price) / MSRP × 100%.

MSRP Data: Obtained from official Volkswagen announcements (Volkswagen US Media), Car and Driver (2024 ID.4 Review), Edmunds (2024 ID.4 Prices), and Cars.com (2024 ID.4 Specs).

Used Car Prices: Sourced from Cars.com (Used ID.4), Kelley Blue Book (ID.4 Prices), and Edmunds (Used ID.4), which provide average used car prices based on factors like mileage, condition, and location.

Key Citations

2023 Volkswagen ID.4 AWD Pro S Review.

Volkswagen ID.4 2023 Pricing Announcement

2024 Volkswagen ID.4 Review, Pricing, and Specs

2024 Volkswagen ID.4 Prices, Reviews, and Pictures

2024 Volkswagen ID.4 Specs, Prices, Range, Reviews

Used Volkswagen ID.4 for Sale Near Me